Multiple Choice

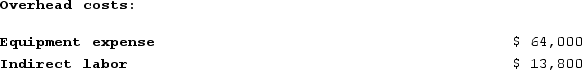

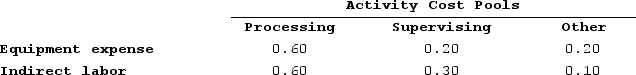

Deemer Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

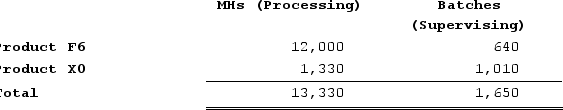

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: What is the overhead cost assigned to Product X0 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

What is the overhead cost assigned to Product X0 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

A) $4,655

B) $15,028

C) $10,373

D) $25,006

Correct Answer:

Verified

Correct Answer:

Verified

Q361: Horgen Corporation manufactures two products: Product M68B

Q362: Nissley Wedding Fantasy Corporation makes very elaborate

Q363: First-stage allocations in an ABC system should

Q364: Immen Corporation manufactures two products: Product B82O

Q365: Lakey Corporation has an activity-based costing system

Q367: Immen Corporation manufactures two products: Product B82O

Q368: Lemaire Corporation is conducting a time-driven activity-based

Q369: Krueger Corporation is conducting a time-driven activity-based

Q370: Purchase order processing is an example of

Q371: Desilets Corporation has provided the following data