Multiple Choice

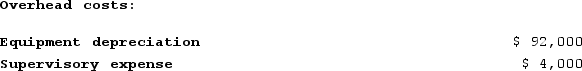

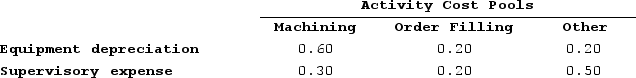

Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment depreciation and supervisory expense--to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

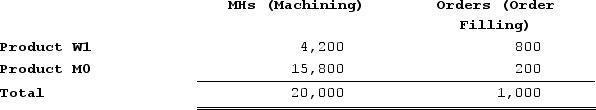

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity:

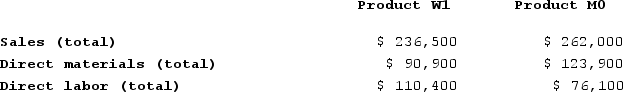

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data: How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

A) $56,400

B) $20,400

C) $55,200

D) $1,200

Correct Answer:

Verified

Correct Answer:

Verified

Q284: Roediger Corporation is conducting a time-driven activity-based

Q285: In the second-stage allocation in activity-based costing,

Q286: Clenney Corporation uses a plantwide overhead rate

Q287: Nissley Wedding Fantasy Corporation makes very elaborate

Q288: The following data have been provided by

Q290: Pierceall Corporation is conducting a time-driven activity-based

Q291: Scheuer Corporation uses activity-based costing to compute

Q292: Brester Corporation is conducting a time-driven activity-based

Q293: In time-based activity-based costing, the practical capacity

Q294: Abel Corporation uses activity-based costing. The company