Multiple Choice

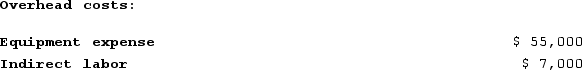

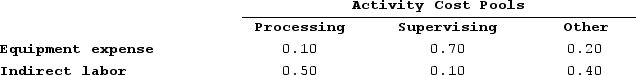

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

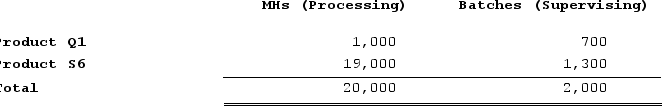

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

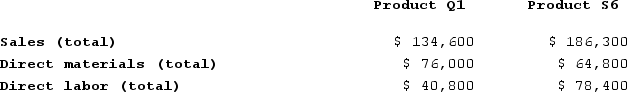

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data: How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

A) $3,500

B) $5,500

C) $9,000

D) $13,800

Correct Answer:

Verified

Correct Answer:

Verified

Q45: Mustafa Enterprises makes a variety of products

Q46: Data concerning three of Kilmon Corporation's activity

Q47: Cieslinski Corporation is conducting a time-driven activity-based

Q48: Zwahlen Corporation has an activity-based costing system

Q49: Cumberland Enterprises makes a variety of products

Q51: Losser Corporation manufactures two products: Product L73Z

Q52: Lamorte Corporation is conducting a time-driven activity-based

Q53: Gendel Corporation is conducting a time-driven activity-based

Q54: Dane Housecleaning provides housecleaning services to its

Q55: Ploof Corporation is conducting a time-driven activity-based