Multiple Choice

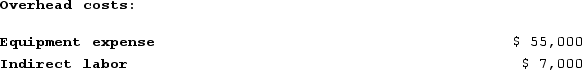

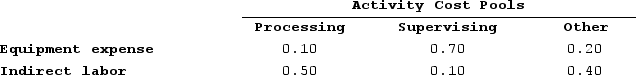

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

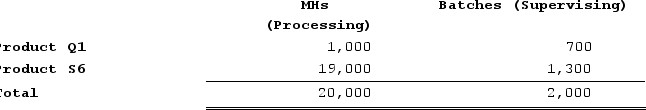

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

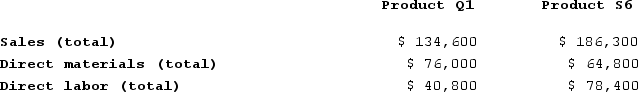

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data: What is the product margin for Product Q1 under activity-based costing?

What is the product margin for Product Q1 under activity-based costing?

A) −$13,200

B) $3,630

C) $17,800

D) $17,350

Correct Answer:

Verified

Correct Answer:

Verified

Q146: Mongiello Corporation is conducting a time-driven activity-based

Q147: Foster Florist specializes in large floral bouquets

Q148: Riedell Corporation is conducting a time-driven activity-based

Q149: Gauch Corporation is conducting a time-driven activity-based

Q150: Data concerning three of Kilmon Corporation's activity

Q152: Code Corporation is conducting a time-driven activity-based

Q153: Doell Corporation is conducting a time-driven activity-based

Q154: Meester Corporation has an activity-based costing system

Q155: Aresco Corporation manufactures two products: Product G51B

Q156: Hails Corporation manufactures two products: Product Q21F