Multiple Choice

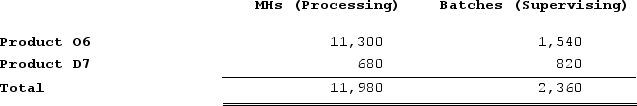

Wedd Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $49,800; Supervising, $27,500; and Other, $24,900. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  What is the overhead cost assigned to Product O6 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

What is the overhead cost assigned to Product O6 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

A) $64,949.00

B) $49,481.00

C) $17,941.00

D) $47,008.00

Correct Answer:

Verified

Correct Answer:

Verified

Q175: Immen Corporation manufactures two products: Product B82O

Q176: Weisgarber Corporation is conducting a time-driven activity-based

Q177: Bennette Corporation has provided the following data

Q178: Nissley Wedding Fantasy Corporation makes very elaborate

Q179: Roediger Corporation is conducting a time-driven activity-based

Q181: Meli Corporation manufactures two products: Product L61P

Q182: Ploof Corporation is conducting a time-driven activity-based

Q183: Schlaefer Corporation is conducting a time-driven activity-based

Q184: Ledonne Corporation is conducting a time-driven activity-based

Q185: Code Corporation is conducting a time-driven activity-based