Multiple Choice

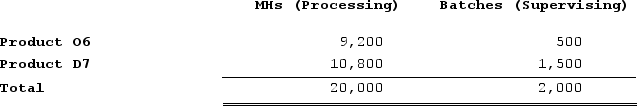

Wedd Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $27,200; Supervising, $9,300; and Other, $9,500. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  What is the overhead cost assigned to Product O6 under activity-based costing?

What is the overhead cost assigned to Product O6 under activity-based costing?

A) $2,325

B) $23,000

C) $14,837

D) $12,512

Correct Answer:

Verified

Correct Answer:

Verified

Q324: Fleisher Corporation is conducting a time-driven activity-based

Q325: Sardella Corporation is conducting a time-driven activity-based

Q326: In a Capacity Analysis report in time-based

Q327: Younan Corporation manufactures two products: Product E47F

Q328: Lindenmuth Corporation is conducting a time-driven activity-based

Q330: Abel Corporation uses activity-based costing. The company

Q331: The Kamienski Cleaning Brigade Company provides housecleaning

Q332: Torello Corporation manufactures two products: Product H95V

Q333: Handal Corporation uses activity-based costing to compute

Q334: Provenzano Corporation manufactures two products: Product B56Z