Multiple Choice

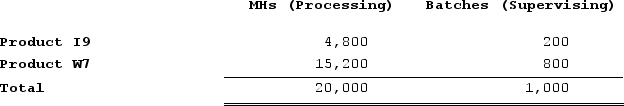

Sorice Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $20,200; Supervising, $11,000; and Other, $66,800. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

A) $7.50 per batch

B) $6.00 per batch

C) $11.00 per batch

D) $98.00 per batch

Correct Answer:

Verified

Correct Answer:

Verified

Q167: The following data have been provided by

Q168: Grassie Corporation is conducting a time-driven activity-based

Q169: Beckley Corporation has provided the following data

Q170: Nissley Wedding Fantasy Corporation makes very elaborate

Q171: In a Cost Analysis report in time-based

Q173: The controller of Hendershot Corporation estimates the

Q174: Hollifield Corporation is conducting a time-driven activity-based

Q175: Immen Corporation manufactures two products: Product B82O

Q176: Weisgarber Corporation is conducting a time-driven activity-based

Q177: Bennette Corporation has provided the following data