Multiple Choice

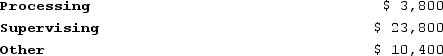

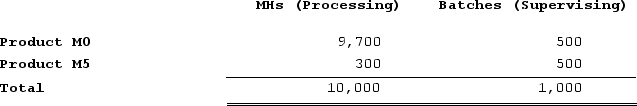

Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

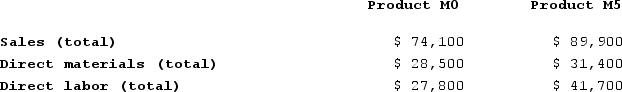

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. What is the overhead cost assigned to Product M5 under activity-based costing?

What is the overhead cost assigned to Product M5 under activity-based costing?

A) $11,900

B) $19,000

C) $114

D) $12,014

Correct Answer:

Verified

Correct Answer:

Verified

Q81: Sukhu Corporation's activity-based costing system has three

Q82: Mcnamee Corporation's activity-based costing system has three

Q83: Time-based activity-based costing does not require extensive

Q84: Ploof Corporation is conducting a time-driven activity-based

Q85: Imbesi Corporation is conducting a time-driven activity-based

Q87: Greife Corporation's activity-based costing system has three

Q88: Hane Corporation uses the following activity rates

Q89: Millner Corporation has provided the following data

Q90: Weissman Corporation manufactures two products: Product E16S

Q91: Tomasini Corporation has provided the following data