Essay

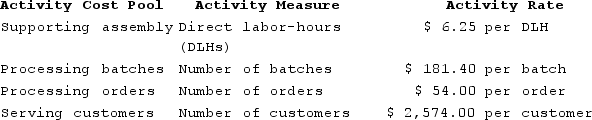

Orick Enterprises makes a variety of products that it sells to other businesses. The company's activity-based costing system has four activity cost pools for assigning costs to products and customers. Details concerning thatactivity-based costing system are listed below:

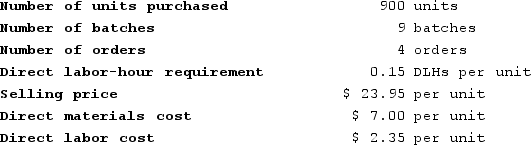

The cost of serving customers, $2,574.00 per customer, is the cost of serving a customer for one year. Peiffer Corporation buys only one of the company's products. The details of last year's purchases of this product are listed below:

The cost of serving customers, $2,574.00 per customer, is the cost of serving a customer for one year. Peiffer Corporation buys only one of the company's products. The details of last year's purchases of this product are listed below:

Required:a. According to the activity-based costing system, what is the cost of the "Supporting assembly" activity for Peiffer Corporation for the year?b. According to theactivity-based costing system, what is the cost of the "Processing batches" activity for Peiffer Corporation for the year?c. According to theactivity-based costing system, what is the cost of the "Processing orders" activity for Peiffer Corporation for the year?d. According to theactivity-based costing system, what is the cost of the "Servicing customers" activity for Peiffer Corporation for the year?e. What is the customer margin on sales to Peiffer Corporation for the year?

Required:a. According to the activity-based costing system, what is the cost of the "Supporting assembly" activity for Peiffer Corporation for the year?b. According to theactivity-based costing system, what is the cost of the "Processing batches" activity for Peiffer Corporation for the year?c. According to theactivity-based costing system, what is the cost of the "Processing orders" activity for Peiffer Corporation for the year?d. According to theactivity-based costing system, what is the cost of the "Servicing customers" activity for Peiffer Corporation for the year?e. What is the customer margin on sales to Peiffer Corporation for the year?

Correct Answer:

Verified

a. Supporting assembly = $6.25 per DLH ×...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q338: Daston Company manufactures two products, Product F

Q339: Orear Corporation manufactures two products: Product Z34D

Q340: Monfort Corporation is conducting a time-driven activity-based

Q341: Howell Corporation's activity-based costing system has three

Q342: Lamorte Corporation is conducting a time-driven activity-based

Q344: Weimar Corporation is conducting a time-driven activity-based

Q345: Bartucci Corporation is conducting a time-driven activity-based

Q346: Mayeux Corporation uses an activity-based costing system

Q347: Mirabile Corporation uses activity-based costing to compute

Q348: Handal Corporation uses activity-based costing to compute