Essay

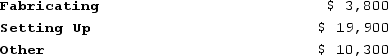

Sukhu Corporation's activity-based costing system has three activity cost pools--Fabricating, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:

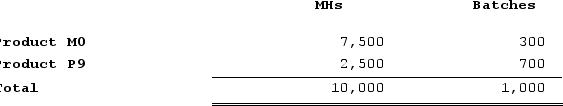

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Required:Calculate activity rates for each activity cost pool using activity-based costing

Required:Calculate activity rates for each activity cost pool using activity-based costing

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Hagy Corporation has an activity-based costing system

Q2: Meli Corporation manufactures two products: Product L61P

Q4: Managing and sustaining product diversity requires many

Q5: Deninno Corporation is conducting a time-driven activity-based

Q6: Bachrodt Corporation uses activity-based costing to compute

Q7: Data concerning three of the activity cost

Q8: Ploof Corporation is conducting a time-driven activity-based

Q9: Cambra Corporation manufactures two products: Product N70E

Q10: The controller of Hendershot Corporation estimates the

Q11: Data concerning three of the activity cost