Essay

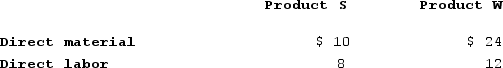

EMD Corporation manufactures two products, Product S and Product W. Product W is of fairly recent origin, having been developed as an attempt to enter a market closely related to that of Product W. Product W is the more complex of the two products, requiring one hour of direct labor time per unit to manufacture compared to one-half hour of direct labor time for Product S. Product W is produced on an automated production line.Overhead is currently assigned to the products on the basis of direct-labor-hours. The company estimated it would incur $500,000 in manufacturing overhead costs and produce 10,000 units of Product W and 60,000 units of Product S during the current year. Unit cost for materials and direct labor are:

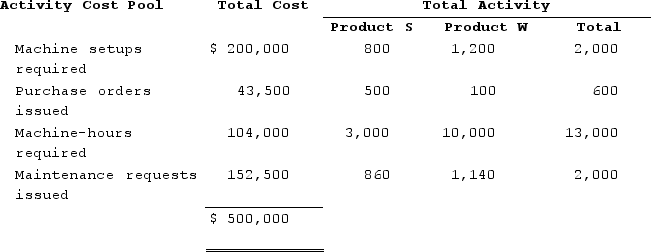

Required:a. Compute the predetermined overhead rate under the current method of allocation and determine the unit product cost of each product for the current year.b. The company's overhead costs can be attributed to four major activities. These activities and the amount of overhead cost attributable to each for the current year are given below:

Required:a. Compute the predetermined overhead rate under the current method of allocation and determine the unit product cost of each product for the current year.b. The company's overhead costs can be attributed to four major activities. These activities and the amount of overhead cost attributable to each for the current year are given below:

Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year.

Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year.

Correct Answer:

Verified

a.The company expects to work 40,000 dir...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: Dane Housecleaning provides housecleaning services to its

Q55: Ploof Corporation is conducting a time-driven activity-based

Q56: Imbesi Corporation is conducting a time-driven activity-based

Q57: In a Cost Analysis report in time-based

Q58: Guerra Electronics manufactures a variety of electronic

Q60: Mosburg Corporation is conducting a time-driven activity-based

Q61: Delauder Enterprises makes a variety of products

Q62: Activity rates from Lippard Corporation's activity-based costing

Q63: Feldpausch Corporation has provided the following data

Q64: Moorman Corporation has an activity-based costing system