Multiple Choice

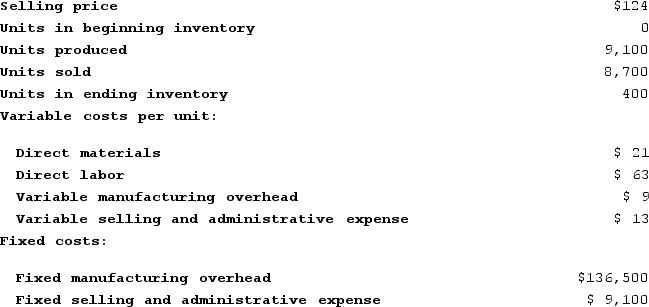

Farris Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  What is the net operating income (loss) for the month under variable costing?

What is the net operating income (loss) for the month under variable costing?

A) $11,000

B) $(26,200)

C) $17,000

D) $6,000

Correct Answer:

Verified

Correct Answer:

Verified

Q206: Krepps Corporation produces a single product. Last

Q207: Delisa Corporation has two divisions: Division L

Q208: Combe Corporation has two divisions: Alpha and

Q209: Buckbee Corporation manufactures and sells one product.

Q210: Kaaua Corporation has provided the following data

Q212: Silver Corporation produces a single product. Last

Q213: Under variable costing, fixed manufacturing overhead is

Q214: Marcelin Corporation manufactures and sells one product.

Q215: Hadley Corporation, which has only one product,

Q216: Davison Corporation, which has only one product,