Multiple Choice

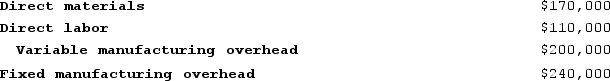

Krepps Corporation produces a single product. Last year, Krepps manufactured 20,000 units and sold 15,000 units. Production costs for the year were as follows:  Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.The contribution margin per unit was:

Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.The contribution margin per unit was:

A) $23.80 per unit

B) $31.00 per unit

C) $25.60 per unit

D) $19.00 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Tustin Corporation has provided the following data

Q35: Younie Corporation has two divisions: the South

Q36: Tubaugh Corporation has two major business segments--East

Q37: Columbia Corporation produces a single product. The

Q38: A manufacturing company that produces a single

Q40: Bryans Corporation has provided the following data

Q41: Erie Corporation manufactures a single product that

Q42: Jemmott Corporation has two divisions: Western Division

Q43: Tustin Corporation has provided the following data

Q44: Absorption costing treats all manufacturing costs as