Multiple Choice

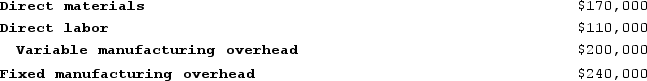

Krepps Corporation produces a single product. Last year, Krepps manufactured 20,000 units and sold 15,000 units. Production costs for the year were as follows:  Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.Under variable costing, the company's net operating income for the year would be:

Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.Under variable costing, the company's net operating income for the year would be:

A) $101,250 lower than under absorption costing.

B) $60,000 lower than under absorption costing.

C) $101,250 higher than under absorption costing.

D) $60,000 higher than under absorption costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q141: Neef Corporation has provided the following data

Q142: Bryans Corporation has provided the following data

Q143: Pacheo Corporation, which has only one product,

Q144: Azuki Corporation operates in two sales territories,

Q145: Danahy Corporation manufactures a single product. The

Q147: Tustin Corporation has provided the following data

Q148: Neef Corporation has provided the following data

Q149: Carriveau Corporation has two divisions: Consumer Division

Q150: Schlenz Incorporated, which produces a single product,

Q151: The Carlsbad Corporation produces and markets two