Multiple Choice

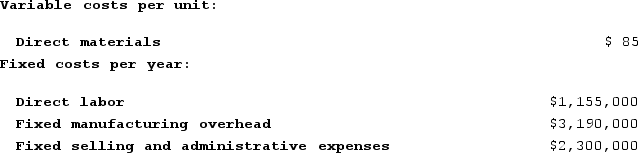

Leheny Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 55,000 units and sold 50,000 units. The company's only product is sold for $238 per unit.Assume that the company uses an absorption costing system that assigns $21 of direct labor cost and $58 of fixed manufacturing overhead to each unit that is produced. The net operating income under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 55,000 units and sold 50,000 units. The company's only product is sold for $238 per unit.Assume that the company uses an absorption costing system that assigns $21 of direct labor cost and $58 of fixed manufacturing overhead to each unit that is produced. The net operating income under this costing system is:

A) $580,000

B) $1,400,000

C) $1,005,000

D) $1,110,000

Correct Answer:

Verified

Correct Answer:

Verified

Q261: The following data pertain to last year's

Q262: Buckbee Corporation manufactures and sells one product.

Q263: The salary paid to a store manager

Q264: Mullee Corporation produces a single product and

Q265: Ieso Corporation has two stores: J and

Q267: Beach Corporation, which produces a single product,

Q268: Phinisee Corporation manufactures a single product. The

Q269: Pacheo Corporation, which has only one product,

Q270: Carlton Corporation has two divisions: Delta and

Q271: Smidt Corporation has provided the following data