Multiple Choice

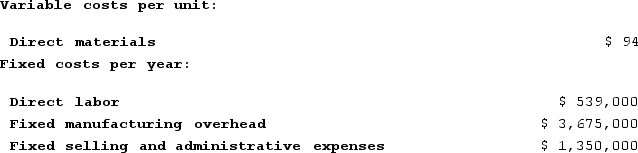

Tremble Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.Assume that the company uses an absorption costing system that assigns $11 of direct labor cost and $75 of fixed manufacturing overhead to each unit that is produced. The unit product cost under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.Assume that the company uses an absorption costing system that assigns $11 of direct labor cost and $75 of fixed manufacturing overhead to each unit that is produced. The unit product cost under this costing system is:

A) $94 per unit

B) $180 per unit

C) $105 per unit

D) $210 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q188: Aaron Corporation, which has only one product,

Q189: In its first year of operations, Bronfren

Q190: Nelter Corporation, which has only one product,

Q191: Aaron Corporation, which has only one product,

Q192: Under variable costing, only variable production costs

Q194: Tremble Corporation manufactures and sells one product.

Q195: Fernstrom Corporation has two divisions: East and

Q196: Davitt Corporation produces a single product and

Q197: Clemeson Corporation, which has only one product,

Q198: Janos Corporation, which has only one product,