Multiple Choice

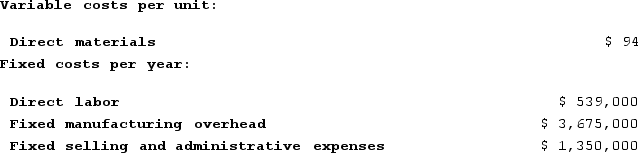

Tremble Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.Assume that the company uses an absorption costing system that assigns $11 of direct labor cost and $75 of fixed manufacturing overhead to each unit that is produced. The net operating income under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.Assume that the company uses an absorption costing system that assigns $11 of direct labor cost and $75 of fixed manufacturing overhead to each unit that is produced. The net operating income under this costing system is:

A) $315,000

B) $1,035,000

C) $735,000

D) $691,000

Correct Answer:

Verified

Correct Answer:

Verified

Q277: Mckissic Corporation has two divisions: Domestic and

Q278: Dallavalle Corporation manufactures and sells one product.

Q279: Carriveau Corporation has two divisions: Consumer Division

Q280: Croft Corporation produces a single product. Last

Q281: Lean production should result in reduced inventories.

Q283: Neef Corporation has provided the following data

Q284: Ross Corporation produces a single product. The

Q285: Bryans Corporation has provided the following data

Q286: Tustin Corporation has provided the following data

Q287: When computing the break even for a