Essay

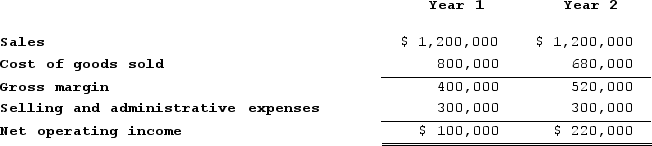

Miller Corporation produces a single product. The company had the following results for its first two years of operation:

In Year 1, the company produced and sold 40,000 units of its only product; in Year 2, the company again sold 40,000 units, but increased production to 50,000 units. The company's variable production cost is $5 per unit and its fixed manufacturing overhead cost is $600,000 a year. Fixed manufacturing overhead costs are applied to the product on the basis of each year's unit production (i.e., a new fixed manufacturing overhead rate is computed each year). Variable selling and administrative expenses are $2 per unit sold.

Required:

a.Compute the unit product cost for each year under absorption costing and under variable costing.

b. Prepare a contribution format income statement for each year using variable costing.

c. Reconcile the variable costing and absorption costing income figures for each year.

d. Explain why the net operating income for Year 2 under absorption costing was higher than the net operating income for Year 1, although the same number of units were sold in each year.

Correct Answer:

Verified

a. Cost per unit under absorption costin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Paparelli Corporation manufactures and sells one product.

Q9: Union Corporation manufactures and sells one product.

Q10: Dallavalle Corporation manufactures and sells one product.

Q11: Souffront Corporation manufactures and sells one product.

Q12: Quates Corporation produces a single product and

Q14: Ober Corporation, which has only one product,

Q15: A company that produces a single product

Q16: Hayworth Corporation has just segmented last year's

Q17: Kern Corporation produces a single product. Selected

Q18: Tubaugh Corporation has two major business segments--East