Essay

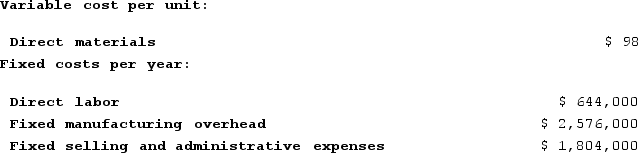

Woodall Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 46,000 units and sold 44,000 units. The company's only product is sold for $235 per unit.Required:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 46,000 units and sold 44,000 units. The company's only product is sold for $235 per unit.Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.b. Assume that the company uses a variable costing system that assigns $14 of direct labor cost to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.c. Assume that the company uses an absorption costing system that assigns $14 of direct labor cost and $56 of fixed manufacturing overhead to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.d. Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net incomes.

e. Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

Correct Answer:

Verified

a.Under super-variable costing, the unit...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: Helmers Corporation manufactures a single product. Variable

Q66: Therrell Corporation has two divisions: Bulb Division

Q67: Qadir Corporation, which has only one product,

Q68: Nurre Corporation manufactures and sells one product.

Q69: Super-variable costing is most appropriate where:<br>A) direct

Q71: Spiess Corporation has two major business segments--Apparel

Q72: Allocating common fixed expenses to business segments:<br>A)

Q73: Nantor Corporation has two divisions, Southern and

Q74: Tremble Corporation manufactures and sells one product.

Q75: Baraban Corporation has provided the following data