Multiple Choice

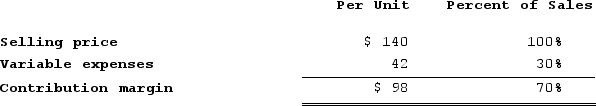

Houpe Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $490,000 per month. The company is currently selling 6,000 units per month.The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept a decrease in their salaries of $58,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $490,000 per month. The company is currently selling 6,000 units per month.The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept a decrease in their salaries of $58,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $700

B) increase of $56,900

C) decrease of $115,300

D) increase of $588,700

Correct Answer:

Verified

Correct Answer:

Verified

Q351: Babuca Corporation has provided the following production

Q352: Derst Incorporated sells a particular textbook for

Q353: Lacourse Incorporated's inspection costs are listed below:

Q354: Last year Easton Corporation reported sales of

Q355: The degree of operating leverage is computed

Q357: Majid Corporation sells a product for $120

Q358: Inspection costs at one of Ratulowski Corporation's

Q359: A shift in the sales mix from

Q360: Lubke Corporation's contribution format income statement for

Q361: Creswell Corporation's fixed monthly expenses are $30,000