Essay

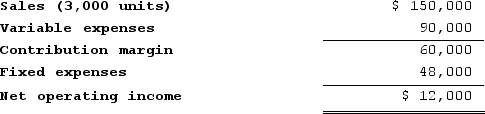

Laraia Corporation has provided the following contribution format income statement. All questions concern situations that are within the relevant range.

Required:

a. What is the contribution margin per unit?

b. What is the contribution margin ratio?

c. What is the variable expense ratio?

d. If sales increase to 3,050 units, what would be the estimated increase in net operating income?

e. If sales decline to 2,900 units, what would be the estimated net operating income?

f. If the selling price increases by $4 per unit and the sales volume decreases by 200 units, what would be the estimated net operating income?

g. If the variable cost per unit increases by $5, spending on advertising increases by $3,000, and unit sales increase by 450 units, what would be the estimated net operating income?

h. What is the break-even point in unit sales?

i. What is the break-even point in dollar sales?

j. Estimate how many units must be sold to achieve a target profit of $54,000.

k. What is the margin of safety in dollars?

l. What is the margin of safety percentage?

m. What is the degree of operating leverage?

n. Using the degree of operating leverage, what is the estimated percent increase in net operating income of a 15% increase in sales volume?

Correct Answer:

Verified

a.

b. CM ratio = Contribution margin ÷ ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b. CM ratio = Contribution margin ÷ ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q238: The margin of safety percentage is equal

Q239: Data concerning Buchenau Corporation's single product appear

Q240: Grawburg Inc. maintains a call center to

Q241: Souza Incorporated, which produces and sells a

Q242: Serfass Corporation's contribution format income statement for

Q244: Hopi Corporation expects the following operating results

Q245: Swofford Inc. has provided the following data

Q246: One of Matthew Corporation's competitors has learned

Q247: A shift in the sales mix from

Q248: Maintenance costs at a Straiton Corporation factory