Multiple Choice

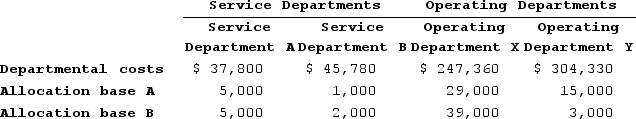

Strzelecki Corporation uses the step-down method to allocate service department costs to operating departments. The company has two service departments, Service Department A and Service Department B, and two operating departments, Operating Department X and Operating Department Y. Data concerning those departments follow:  Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.In the first step of the allocation, the amount of Service Department A cost allocated to the Operating Department X is closest to:

Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.In the first step of the allocation, the amount of Service Department A cost allocated to the Operating Department X is closest to:

A) $24,360

B) $21,924

C) $16,948

D) $24,914

Correct Answer:

Verified

Correct Answer:

Verified

Q322: Bistrol Corporation uses the weighted-average method in

Q323: Claus Corporation manufactures a single product and

Q324: Marlow Corporation uses the first-in, first-out method

Q325: The equivalent units in beginning work in

Q326: Blondell Legal Services, Limited Liability Company, uses

Q328: When computing the cost per equivalent unit,

Q329: Paceheco Corporation uses the weighted-average method in

Q330: Tabet Corporation uses the first-in, first-out method

Q331: Gunes Corporation uses the weighted-average method in

Q332: Mullins Corporation uses the first-in, first-out method