Multiple Choice

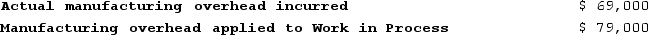

Faughn Corporation has provided the following data concerning manufacturing overhead for July:  The company's Cost of Goods Sold was $243,000 prior to closing out its Manufacturing Overhead account. The company closes out its Manufacturing Overhead account to Cost of Goods Sold. Which of the following statements is true?

The company's Cost of Goods Sold was $243,000 prior to closing out its Manufacturing Overhead account. The company closes out its Manufacturing Overhead account to Cost of Goods Sold. Which of the following statements is true?

A) Manufacturing overhead was underapplied by $10,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $233,000

B) Manufacturing overhead was overapplied by $10,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $233,000

C) Manufacturing overhead was overapplied by $10,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $253,000

D) Manufacturing overhead was underapplied by $10,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $253,000

Correct Answer:

Verified

Correct Answer:

Verified

Q133: Refer to the T-account below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8314/.jpg"

Q134: Centore Incorporated has provided the following data

Q135: Weyant Corporation has provided the following data

Q136: Amunrud Corporation uses a job-order costing system

Q137: Koczela Incorporated has provided the following data

Q139: Entry (1) in the below T-account represents

Q140: Dukes Corporation used a predetermined overhead rate

Q141: Plocek Corporation uses a job-order costing system

Q142: Refer to the T-account below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8314/.jpg"

Q143: During December, Moulding Corporation incurred $76,000 of