Multiple Choice

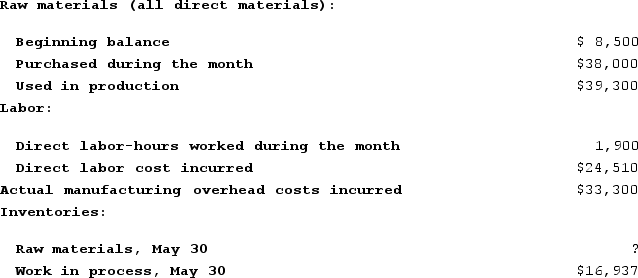

Dacosta Corporation had only one job in process on May 1. The job had been charged with $1,800 of direct materials, $6,966 of direct labor, and $9,936 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $18.40 per direct labor-hour. During May, the following activity was recorded: Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

A) credit of $5,336 to Manufacturing Overhead.

B) credit of $1,660 to Manufacturing Overhead.

C) debit of $5,336 to Manufacturing Overhead.

D) debit of $1,660 to Manufacturing Overhead.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: In the Schedule of Cost of Goods

Q39: On November 1, Arvelo Corporation had $39,500

Q40: Baka Corporation applies manufacturing overhead on the

Q41: If a company closes any underapplied or

Q42: Bocchini Corporation has provided the following data

Q44: Tevebaugh Corporation is a manufacturer that uses

Q45: Heathcote Corporation is a manufacturer that uses

Q46: Chavez Corporation reported the following data for

Q47: Verrett Corporation is a manufacturer that uses

Q48: Compute the amount of raw materials used