Essay

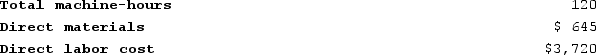

Saxon Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on 10,000 machine-hours, total fixed manufacturing overhead cost of $91,000, and a variable manufacturing overhead rate of $2.40 per machine-hour. Job K373, which was for 60 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:a. Calculate the estimated total manufacturing overhead for the year.b. Calculate the predetermined overhead rate for the year.c. Calculate the amount of overhead applied to Job K373.d. Calculate the total job cost for Job K373.e. Calculate the unit product cost for Job K373

Required:a. Calculate the estimated total manufacturing overhead for the year.b. Calculate the predetermined overhead rate for the year.c. Calculate the amount of overhead applied to Job K373.d. Calculate the total job cost for Job K373.e. Calculate the unit product cost for Job K373

Correct Answer:

Verified

a. Estimated total manufacturing overhea...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Fatzinger Corporation has two production departments, Milling

Q44: Marciante Corporation has two production departments, Casting

Q45: Kostelnik Corporation uses a job-order costing system

Q46: Pangle Corporation has two production departments, Forming

Q47: The management of Michaeli Corporation would like

Q49: Harootunian Corporation uses a job-order costing system

Q50: Kavin Corporation uses a predetermined overhead rate

Q51: Harootunian Corporation uses a job-order costing system

Q52: Assigning manufacturing overhead to a specific job

Q53: Halbur Corporation has two manufacturing departments--Machining and