Essay

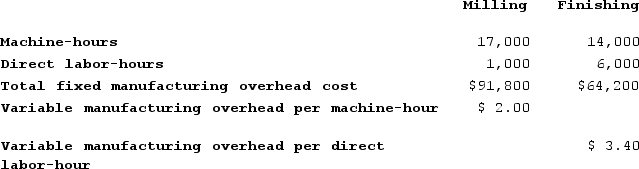

Dancel Corporation has two production departments, Milling and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

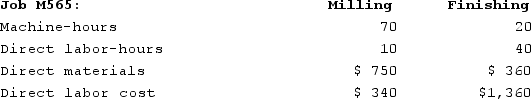

During the current month the company started and finished Job M565. The following data were recorded for this job:

During the current month the company started and finished Job M565. The following data were recorded for this job:

Required:a. Calculate the total amount of overhead applied to Job M565 in both departments.b. Calculate the total job cost for Job M565.c. Calculate the selling price for Job M565 if the company marks up its unit product costs by 20% to determine selling prices.

Required:a. Calculate the total amount of overhead applied to Job M565 in both departments.b. Calculate the total job cost for Job M565.c. Calculate the selling price for Job M565 if the company marks up its unit product costs by 20% to determine selling prices.

Correct Answer:

Verified

a. Milling Department:

Milling Departmen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Milling Departmen...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q178: Claybrooks Corporation has two manufacturing departments--Casting and

Q179: Job-order costing systems often use allocation bases

Q180: Macnamara Corporation has two manufacturing departments--Casting and

Q181: Prayer Corporation has two production departments, Machining

Q182: Harnett Corporation has two manufacturing departments--Molding and

Q184: Camm Corporation has two manufacturing departments--Forming and

Q185: Lueckenhoff Corporation uses a job-order costing system

Q186: Adelberg Corporation makes two products: Product A

Q187: Look Manufacturing Corporation has a traditional costing

Q188: Giannitti Corporation bases its predetermined overhead rate