Essay

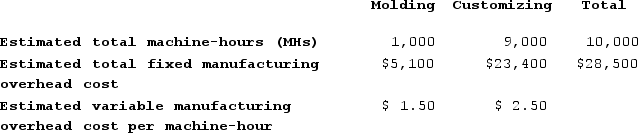

Sonneborn Corporation has two manufacturing departments--Molding and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:

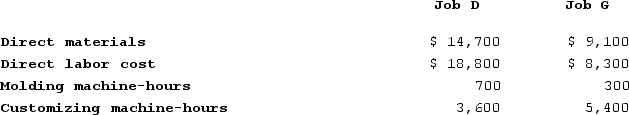

During the most recent month, the company started and completed two jobs--Job D and Job G. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job D and Job G. There were no beginning inventories. Data concerning those two jobs follow:

Required:a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job D.b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job G.c. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job D?d. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job G?

Required:a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job D.b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job G.c. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job D?d. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job G?

Correct Answer:

Verified

a.The first step is to calculate the est...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q281: Prather Corporation uses a job-order costing system

Q282: Beans Corporation uses a job-order costing system

Q283: Branin Corporation uses a job-order costing system

Q284: Mcewan Corporation uses a job-order costing system

Q285: Branin Corporation uses a job-order costing system

Q287: Merati Corporation has two manufacturing departments--Forming and

Q288: Mahon Corporation has two production departments, Casting

Q289: Collini Corporation has two production departments, Machining

Q290: Gerstein Corporation uses a job-order costing system

Q291: Dejarnette Corporation uses a job-order costing system