Essay

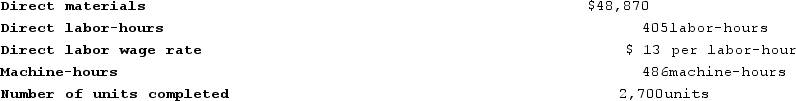

Job 243 was recently completed. The following data have been recorded on its job cost sheet:

The company applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $11 per machine-hour.Required:Compute the unit product cost that would appear on the job cost sheet for this job.

The company applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $11 per machine-hour.Required:Compute the unit product cost that would appear on the job cost sheet for this job.

Correct Answer:

Verified

Correct Answer:

Verified

Q273: Werger Manufacturing Corporation has a traditional costing

Q274: The management of Kotek Corporation would like

Q275: Generally speaking, when going through the process

Q276: Hultquist Corporation has two manufacturing departments--Forming and

Q277: Claybrooks Corporation has two manufacturing departments--Casting and

Q279: Bernson Corporation is using a predetermined overhead

Q280: Lupo Corporation uses a job-order costing system

Q281: Prather Corporation uses a job-order costing system

Q282: Beans Corporation uses a job-order costing system

Q283: Branin Corporation uses a job-order costing system