Essay

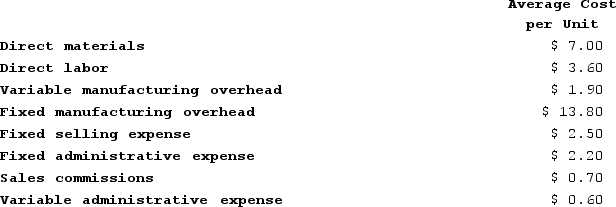

Balerio Corporation's relevant range of activity is 6,000 units to 11,000 units. When it produces and sells 8,000 units, its average costs per unit are as follows:

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 8,000 units? (Do not round intermediate calculations.)b. If 10,000 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold? (Do not round intermediate calculations. Round "Per unit" answer to 2 decimal places.)d. If the selling price is $18.60 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)e. What incremental manufacturing cost will the company incur if it increases production from 8,000 to 8,001 units? (Round "Per unit" answer to 2 decimal places.)

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 8,000 units? (Do not round intermediate calculations.)b. If 10,000 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold? (Do not round intermediate calculations. Round "Per unit" answer to 2 decimal places.)d. If the selling price is $18.60 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)e. What incremental manufacturing cost will the company incur if it increases production from 8,000 to 8,001 units? (Round "Per unit" answer to 2 decimal places.)

Correct Answer:

Verified

a.

b.

b.

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Glew Corporation has provided the following information:

Q14: Abburi Company's manufacturing overhead is 60% of

Q15: Wages paid to production supervisors would be

Q16: A contribution format income statement separates costs

Q17: Boersma Sales, Incorporated a merchandising company, reported

Q19: Myklebust Corporation's relevant range of activity is

Q20: Management of Plascencia Corporation is considering whether

Q21: Rhome Corporation's relevant range of activity is

Q22: Which of the following is an example

Q23: A cost can be direct or indirect.