Essay

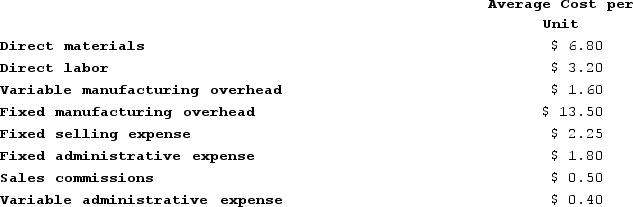

Balerio Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows:

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units? (Do not round intermediate calculations.)b. If 10,000 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold? (Do not round intermediate calculations. Round "Per unit" answer to 2 decimal places.)d. If the selling price is $18.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)e. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units? (Round "Per unit" answer to 2 decimal places.)

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units? (Do not round intermediate calculations.)b. If 10,000 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold? (Do not round intermediate calculations. Round "Per unit" answer to 2 decimal places.)d. If the selling price is $18.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)e. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units? (Round "Per unit" answer to 2 decimal places.)

Correct Answer:

Verified

a.

b.

b.

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q222: Delongis Corporation, a merchandising company, reported the

Q223: Bolka Corporation, a merchandising company, reported the

Q224: Product costs are also known as inventoriable

Q225: Lagle Corporation has provided the following information:

Q226: A fixed cost is not constant per

Q228: Delongis Corporation, a merchandising company, reported the

Q229: Mark is an engineer who has designed

Q230: Streif Incorporated a local retailer, has provided

Q231: Selling costs are indirect costs.

Q232: A direct cost is a cost that