Multiple Choice

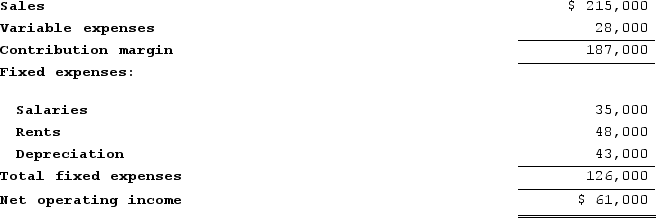

Olinick Corporation is considering a project that would require an investment of $329,000 and would last for 8 years. The incremental annual revenues and expenses generated by the project during those 8 years would be as follows (Ignore income taxes.) :  The scrap value of the project's assets at the end of the project would be $25,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to: (Round your answer to 1 decimal place.)

The scrap value of the project's assets at the end of the project would be $25,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to: (Round your answer to 1 decimal place.)

A) 3.2 years

B) 5.4 years

C) 4.3 years

D) 2.8 years

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Joetz Corporation has gathered the following data

Q5: Joetz Corporation has gathered the following data

Q6: The management of Harling Corporation is considering

Q7: Perkins Corporation is considering several investment proposals,

Q8: The internal rate of return method assumes

Q10: The present value of a cash flow

Q11: Given the following data (Ignore income taxes.):

Q12: Charlie Corporation is considering buying a new

Q13: The profitability index and the internal rate

Q14: Eddie Corporation is considering the following three