Multiple Choice

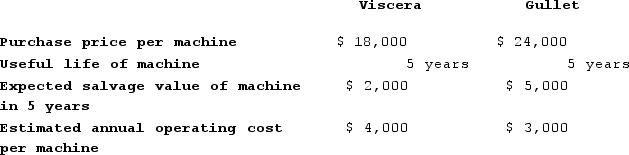

Cannula Vending Corporation is expanding operations and needs to purchase additional vending machines. There are currently two companies, Viscera, Incorporated and Gullet International, that produce and sell machines that will do the job. Information related to the specifications of each company's machine are as follows (Ignore income taxes.) :  Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Cannula's discount rate is 18%. Cannula uses the straight-line method of depreciation. Using net present value analysis, which company's machine should Cannula purchase and what is the approximate difference between the net present values of the competing company's machines?

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Cannula's discount rate is 18%. Cannula uses the straight-line method of depreciation. Using net present value analysis, which company's machine should Cannula purchase and what is the approximate difference between the net present values of the competing company's machines?

A) Gullet, $127

B) Viscera, $1,562

C) Viscera, $1,749

D) Viscera, $3,438

Correct Answer:

Verified

Correct Answer:

Verified

Q104: Przewozman Corporation has provided the following information

Q105: A company wants to have $40,000 at

Q106: The management of Osborn Corporation is investigating

Q107: (Ignore income taxes in this problem.) Bradley

Q108: Mester Corporation has provided the following information

Q110: You have deposited $25,165 in a special

Q111: The management of Leitheiser Corporation is considering

Q112: Truskowski Corporation has provided the following information

Q113: Vandezande Incorporated is considering the acquisition of

Q114: Prudencio Corporation has provided the following information