Multiple Choice

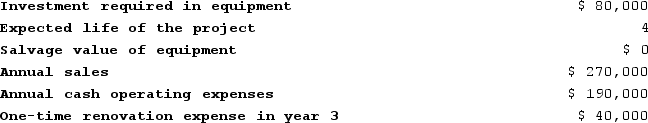

Mesko Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the entire project is closest to:

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the entire project is closest to:

A) $78,648

B) $168,000

C) $97,072

D) $140,000

Correct Answer:

Verified

Correct Answer:

Verified

Q393: Coache Corporation is considering a capital budgeting

Q394: Dobrinski Corporation has provided the following information

Q395: The management of Hansley Corporation is investigating

Q396: The management of Hibert Corporation is considering

Q397: The management of Elamin Corporation is considering

Q399: The management of Hansley Corporation is investigating

Q400: Almendarez Corporation is considering the purchase of

Q401: At an interest rate of 14%, approximately

Q402: Morefield Corporation has provided the following information

Q403: Donayre Corporation is considering a capital budgeting