Multiple Choice

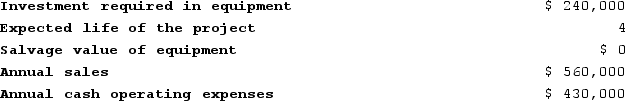

Manjarrez Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 6%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 6%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

A) $109,000

B) $130,000

C) $70,000

D) $21,000

Correct Answer:

Verified

Correct Answer:

Verified

Q78: Cooney Incorporated has provided the following data

Q79: Choudhury Corporation is considering the following three

Q80: An increase in the expected salvage value

Q81: An investment project requires an initial investment

Q82: Mattice Corporation is considering investing $440,000 in

Q84: Roemen Corporation is considering a capital budgeting

Q85: The management of Winstead Corporation is considering

Q86: The following information concerning a proposed capital

Q87: Income taxes have no effect on whether

Q88: The simple rate of return is computed