Multiple Choice

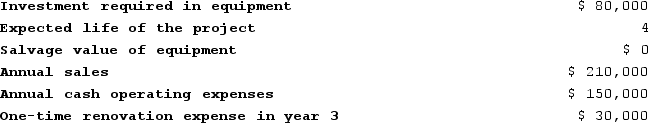

Planas Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 3 is:

The company's income tax rate is 30% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 3 is:

A) $12,000

B) $18,000

C) $3,000

D) $9,000

Correct Answer:

Verified

Correct Answer:

Verified

Q211: The management of Truelove Corporation is considering

Q212: Joetz Corporation has gathered the following data

Q213: Hinger Corporation is considering a capital budgeting

Q214: Boynes Corporation is considering a capital budgeting

Q215: Dunstan Corporation is considering a capital budgeting

Q217: Falkowski Corporation has provided the following information

Q218: Paragas, Incorporated, is considering the purchase of

Q219: Vandezande Incorporated is considering the acquisition of

Q220: The present value of an amount to

Q221: Bedolla Corporation is considering a capital budgeting