Essay

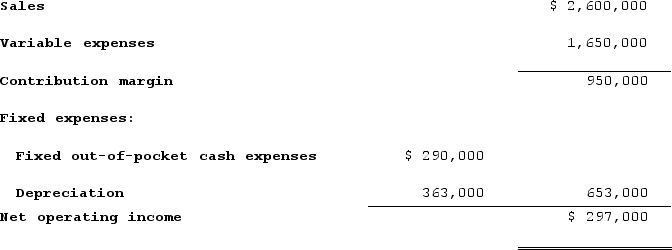

Ursus, Incorporated, is considering a project that would have a eight-year life and would require a $2,904,000 investment in equipment. At the end of eight years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows (Ignore income taxes.):

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 11%.Required:a. Compute the project's net present value. (Round your intermediate calculations and final answer to the nearest whole dollar amount.)

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 11%.Required:a. Compute the project's net present value. (Round your intermediate calculations and final answer to the nearest whole dollar amount.)

b. Compute the project's internal rate of return. (Round your final answer to the nearest whole percent.)

c. Compute the project's payback period. (Round your answer to 2 decimal place.)

d. Compute the project's simple rate of return. (Round your final answer to the nearest whole percent.)

Correct Answer:

Verified

a. Because depreciation is the only nonc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q314: Lambert Manufacturing has $120,000 to invest in

Q315: Mattice Corporation is considering investing $820,000 in

Q316: The management of Osborn Corporation is investigating

Q317: When a company is cash poor, a

Q318: The management of Lanzilotta Corporation is considering

Q320: Morrel University has a small shuttle bus

Q321: Vanzant Corporation has provided the following information

Q322: Hinger Corporation is considering a capital budgeting

Q323: Marbry Corporation has provided the following information

Q324: Rollans Corporation has provided the following information