Multiple Choice

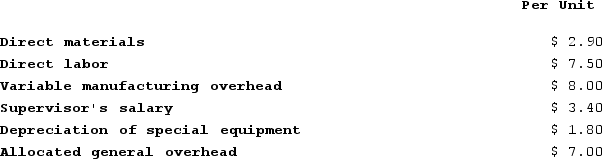

Part U16 is used by Mcvean Corporation to make one of its products. A total of 13,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make the part and sell it to the company for $29.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. In addition, the space used to make part U16 could be used to make more of one of the company's other products, generating an additional segment margin of $25,000 per year for that product. The annual financial advantage (disadvantage) for the company as a result of buying part U16 from the outside supplier should be:

An outside supplier has offered to make the part and sell it to the company for $29.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. In addition, the space used to make part U16 could be used to make more of one of the company's other products, generating an additional segment margin of $25,000 per year for that product. The annual financial advantage (disadvantage) for the company as a result of buying part U16 from the outside supplier should be:

A) $25,000

B) ($79,000)

C) ($35,400)

D) $14,600

Correct Answer:

Verified

Correct Answer:

Verified

Q52: The sensitivity of unit sales to changes

Q53: Tavis Robotics Corporation has developed a new

Q54: Kinsley Corporation manufactures numerous products, one of

Q55: Home Products, Incorporated, is planning the introduction

Q56: Elfalan Corporation produces a single product. The

Q58: Paluso Corporation manufactures numerous products, one of

Q59: Fixed costs are irrelevant in decisions about

Q60: Opportunity costs represent costs that can be

Q61: Penagos Corporation is presently making part Z43

Q62: Costs that can be eliminated in whole