Multiple Choice

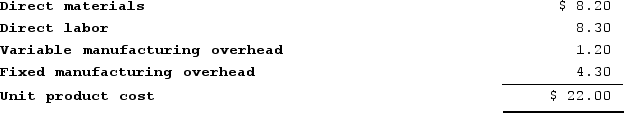

Sardi Incorporated is considering whether to continue to make a component or to buy it from an outside supplier. The company uses 17,000 of the components each year. The unit product cost of the component according to the company's cost accounting system is given as follows:  Assume that direct labor is a variable cost. Of the fixed manufacturing overhead, 70% is avoidable if the component were bought from the outside supplier. In addition, making the component uses 2 minutes on the machine that is the company's current constraint. If the component were bought, time would be freed up for use on another product that requires 4 minutes on this machine and that has a contribution margin of $7.00 per unit.When deciding whether to make or buy the component, what cost of making the component should be compared to the price of buying the component? (Round your intermediate calculations to 2 decimal places.)

Assume that direct labor is a variable cost. Of the fixed manufacturing overhead, 70% is avoidable if the component were bought from the outside supplier. In addition, making the component uses 2 minutes on the machine that is the company's current constraint. If the component were bought, time would be freed up for use on another product that requires 4 minutes on this machine and that has a contribution margin of $7.00 per unit.When deciding whether to make or buy the component, what cost of making the component should be compared to the price of buying the component? (Round your intermediate calculations to 2 decimal places.)

A) $24.21 per unit

B) $25.50 per unit

C) $20.71 per unit

D) $22.00 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q287: In the absorption approach to cost-plus pricing,

Q288: Mercer Corporation estimates that an investment of

Q289: Product X-547 is one of the joint

Q290: Ohanlon Corporation manufactures numerous products, one of

Q291: Morice Industries Incorporated has developed a new

Q293: A cost that is assigned to a

Q294: Stinehelfer Beet Processors, Incorporated, processes sugar beets

Q295: Management of Niemczyk Corporation is considering a

Q296: Generally speaking, managers should set higher prices

Q297: Priddy Corporation processes sugar cane in batches.