Multiple Choice

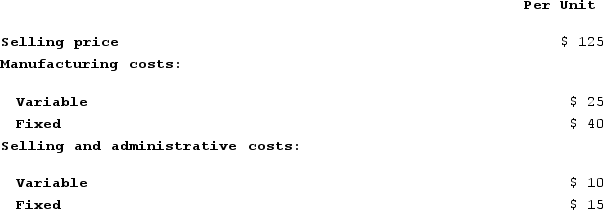

CoolAir Corporation manufactures portable window air conditioners. CoolAir has the capacity to manufacture and sell 80,000 air conditioners each year but is currently only manufacturing and selling 60,000. The following per unit numbers relate to annual operations at 60,000 units:  The City of Clearwater would like to purchase 3,000 air conditioners from CoolAir but only if they can get them for $75 each. Variable selling and administrative costs on this special order will drop down to $2 per unit. This special order will not affect the 60,000 regular sales and it will not affect the total fixed costs. The annual financial advantage (disadvantage) for the company as a result of accepting this special order from the City of Clearwater should be:

The City of Clearwater would like to purchase 3,000 air conditioners from CoolAir but only if they can get them for $75 each. Variable selling and administrative costs on this special order will drop down to $2 per unit. This special order will not affect the 60,000 regular sales and it will not affect the total fixed costs. The annual financial advantage (disadvantage) for the company as a result of accepting this special order from the City of Clearwater should be:

A) ($21,000)

B) $24,000

C) $144,000

D) ($129,000)

Correct Answer:

Verified

Correct Answer:

Verified

Q184: The split-off point in a process that

Q185: The management of Rademacher Corporation is considering

Q186: Yashinski Corporation manufactures numerous products, one of

Q187: Schickel Incorporated regularly uses material B39U and

Q188: Morice Industries Incorporated has developed a new

Q190: Prosner Corporation manufactures three products from a

Q191: WP Corporation produces products X, Y, and

Q192: Kirsten Corporation makes 100,000 units per year

Q193: The management of Landstrom Corporation would like

Q194: Willow Corporation manufactures and sells 20,000 units