Multiple Choice

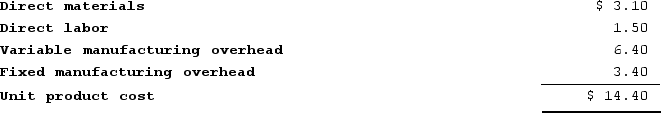

A customer has requested that Lewelling Corporation fill a special order for 9,000 units of product S47 for $20.50 a unit. While the product would be modified slightly for the special order, product S47's normal unit product cost is $14.40:  Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product S47 that would increase the variable costs by $5.00 per unit and that would require an investment of $36,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product S47 that would increase the variable costs by $5.00 per unit and that would require an investment of $36,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

A) $(9,900)

B) $4,500

C) $54,900

D) $(26,100)

Correct Answer:

Verified

Correct Answer:

Verified

Q347: Nance Corporation is about to introduce a

Q348: Magney, Incorporated, uses the absorption costing approach

Q349: Contento Corporation manufactures numerous products, one of

Q350: Companies often allocate common fixed costs among

Q351: The management of Woznick Corporation has been

Q353: Jaakola Corporation makes a product with the

Q354: The Tolar Corporation has 400 obsolete desk

Q355: Nance Corporation is about to introduce a

Q356: A vertically integrated company is less dependent

Q357: Elfalan Corporation produces a single product. The