Multiple Choice

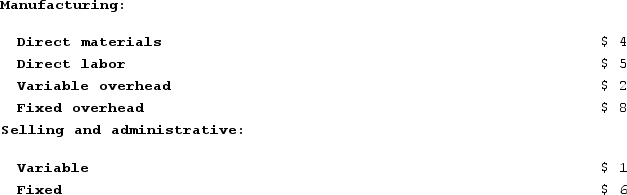

The following are Silver Corporation's unit costs of making and selling an item at a volume of 8,000 units per month (which represents the company's capacity) :  Present sales amount to 7,000 units per month. An order has been received from a customer in a foreign market for 1,000 units. The order would not affect regular sales. Total fixed costs, both manufacturing and selling and administrative, would not be affected by this order. The variable selling and administrative costs would have to be incurred for this special order as well as all other sales. Assume that direct labor is a variable cost.Assume the company has 50 units left over from last year which have small defects and which will have to be sold at a reduced price for scrap. The sale of these defective units will have no effect on the company's other sales. Which of the following costs is relevant in this decision?

Present sales amount to 7,000 units per month. An order has been received from a customer in a foreign market for 1,000 units. The order would not affect regular sales. Total fixed costs, both manufacturing and selling and administrative, would not be affected by this order. The variable selling and administrative costs would have to be incurred for this special order as well as all other sales. Assume that direct labor is a variable cost.Assume the company has 50 units left over from last year which have small defects and which will have to be sold at a reduced price for scrap. The sale of these defective units will have no effect on the company's other sales. Which of the following costs is relevant in this decision?

A) $11 variable manufacturing cost

B) $19 unit product cost

C) $1 variable selling and administrative cost

D) $26 full cost

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Chruch Corporation manufactures numerous products, one of

Q36: The management of Bonga Corporation is considering

Q37: Ladle Corporation uses the absorption costing approach

Q38: The management of Musselman Corporation would like

Q39: One of the employees of Davenport Corporation

Q41: Kirgan, Incorporated, manufactures a product with the

Q42: Kinsi Corporation manufactures five different products. All

Q43: Ecob Corporation uses the absorption costing approach

Q44: Saalfrank Corporation is considering two alternatives that

Q45: Bruce Corporation makes four products in a