Multiple Choice

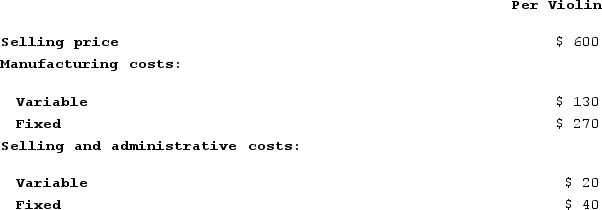

The Bharu Violin Corporation has the capacity to manufacture and sell 5,000 violins each year but is currently only manufacturing and selling 4,800. The following data relate to annual operations at 4,800 units:  Woolgar Symphony Orchestra is interested in purchasing Bharu's excess capacity of 200 units but only if they can get the violins for $350 each. This special order would not affect regular sales or the total fixed costs.Assume that Bharu is manufacturing and selling at capacity (5,000 units) . Any special order will mean a loss of regular sales. Under these conditions if the special order from Woolgar Symphony Orchestra is accepted, the financial advantage (disadvantage) Bharu for the year should be:

Woolgar Symphony Orchestra is interested in purchasing Bharu's excess capacity of 200 units but only if they can get the violins for $350 each. This special order would not affect regular sales or the total fixed costs.Assume that Bharu is manufacturing and selling at capacity (5,000 units) . Any special order will mean a loss of regular sales. Under these conditions if the special order from Woolgar Symphony Orchestra is accepted, the financial advantage (disadvantage) Bharu for the year should be:

A) $20,000

B) ($22,000)

C) ($28,000)

D) ($50,000)

Correct Answer:

Verified

Correct Answer:

Verified

Q369: Minden Corporation estimates that the following costs

Q370: Bertucci Corporation makes three products that use

Q371: Hanisch Corporation would like to use target

Q372: Mae Refiners, Incorporated, processes sugar cane that

Q373: In a factory operating at capacity, every

Q375: Cables Electronics Corporation has developed a new

Q376: Gordon Corporation produces 1,000 units of a

Q377: A new product, an automated crepe maker,

Q378: Anglen Company manufactures and sells trophies for

Q379: The constraint at Rauchwerger Corporation is time