Multiple Choice

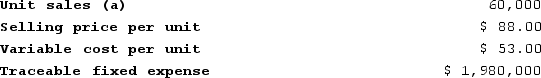

Eastwood Corporation manufactures numerous products, one of which is called Beta96. The company has provided the following data about this product:  Management is considering decreasing the price of Beta96 by 8%, from $88.00 to $80.96. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 60,000 units to 66,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta96 earn at a price of $80.96 if this sales forecast is correct?

Management is considering decreasing the price of Beta96 by 8%, from $88.00 to $80.96. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 60,000 units to 66,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta96 earn at a price of $80.96 if this sales forecast is correct?

A) $1,845,360

B) $1,677,600

C) −$302,400

D) −$134,640

Correct Answer:

Verified

Correct Answer:

Verified

Q208: The Tolar Corporation has 500 obsolete desk

Q209: Boggess Corporation manufactures numerous products, one of

Q210: Ludy Mechanical Corporation has developed a new

Q211: The management of Rademacher Corporation is considering

Q212: Target costing involves adding a target profit

Q214: A study has been conducted to determine

Q215: Ahrends Corporation makes 70,000 units per year

Q216: In a sell or process further decision,

Q217: The management of Furrow Corporation is considering

Q218: Companies that use value-based pricing establish selling