Multiple Choice

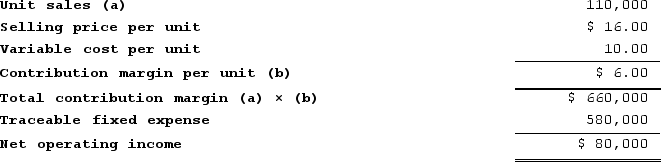

Spach Corporation manufactures numerous products, one of which is called Beta68. The company has provided the following data about this product:  Management is considering decreasing the price of Beta68 by 5%, from $16.00 to $15.20. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 110,000 units to 121,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta68 earn at a price of $15.20 if this sales forecast is correct?

Management is considering decreasing the price of Beta68 by 5%, from $16.00 to $15.20. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 110,000 units to 121,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta68 earn at a price of $15.20 if this sales forecast is correct?

A) $629,200

B) $572,000

C) ($8,000)

D) $49,200

Correct Answer:

Verified

Correct Answer:

Verified

Q88: The opportunity cost of making a component

Q89: Pascal Corporation manufactures numerous products, one of

Q90: The markup over cost under the absorption

Q91: Kopec Corporation manufactures numerous products, one of

Q92: The target costing approach was developed in

Q94: If the formula for the markup percentage

Q95: The most recent monthly income statement for

Q96: Paine Corporation processes sugar beets in batches

Q97: Sardi Incorporated is considering whether to continue

Q98: Ecob Corporation uses the absorption costing approach