Essay

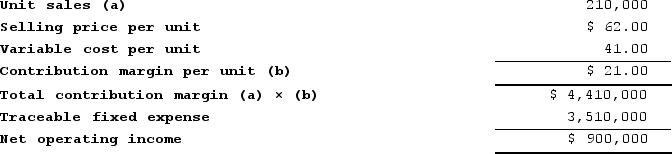

Ohanlon Corporation manufactures numerous products, one of which is called Delta-27. The company has provided the following data about this product:

Required:a. Management is considering increasing the price of Delta-27 by 5%, from $62.00 to $65.10. The company's marketing managers estimate that this price hike would decrease unit sales by 10%, from 210,000 units to 189,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will Delta-27 earn at a price of $65.10 if this sales forecast is correct?b. Assuming that the total traceable fixed expense does not change, if Ohanlon increases the price of Delta-27 to $65.10, what percentage change in unit sales would provide the same net operating income that it currently earns at a price of $62.00? (Round your "Percentage" answer to 1 decimal place.)

Required:a. Management is considering increasing the price of Delta-27 by 5%, from $62.00 to $65.10. The company's marketing managers estimate that this price hike would decrease unit sales by 10%, from 210,000 units to 189,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will Delta-27 earn at a price of $65.10 if this sales forecast is correct?b. Assuming that the total traceable fixed expense does not change, if Ohanlon increases the price of Delta-27 to $65.10, what percentage change in unit sales would provide the same net operating income that it currently earns at a price of $62.00? (Round your "Percentage" answer to 1 decimal place.)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Rapson Pure Water Solutions Corporation has developed

Q3: Marvel Corporation estimates that the following costs

Q4: Cranston Corporation makes four products in a

Q5: Glover Company makes three products in a

Q6: Nance Corporation is about to introduce a

Q7: In a special order situation, any fixed

Q8: Garson, Incorporated produces three products. Data concerning

Q9: A product whose revenues do not cover

Q10: Perwin Corporation estimates that an investment of

Q11: A customer has asked Lalka Corporation to