Multiple Choice

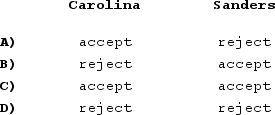

Edith Carolina is president of the Deed Corporation. The company is decentralized, and leaves investment decisions up to the discretion of the division managers. Michael Sanders, manager of the Cosmetics Division, has had a return on investment of 14% for his division for the past three years and expects the division to have the same return in the coming year. Sanders has the opportunity to invest in a new line of cosmetics which is expected to have a return on investment of 12%. The company's minimum required rate of return is 8%.If the Deed Corporation evaluates managerial performance using residual income based on the corporate minimum required rate of return of 8%, what decision would be preferred by Edith Carolina and Michael Sanders?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Correct Answer:

Verified

Q55: Brodrick Corporation uses residual income to evaluate

Q56: The West Division of Cecchetti Corporation had

Q57: Cabell Products is a division of a

Q58: The Millard Division's operating data for the

Q59: Wetherald Products, Incorporated, has a Pump Division

Q61: Sauseda Corporation has two operating divisions-an Inland

Q62: The Tipton Division of Dudley Company reported

Q63: Royal Products, Incorporated, has a Connector Division

Q64: Bacot Products, Incorporated, has a Valve Division

Q65: The following data are for the Akron