Multiple Choice

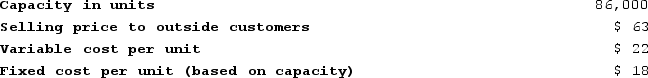

Stokan Products, Incorporated, has a Antennae Division that manufactures and sells a number of products, including a standard antennae that could be used by another division in the company, the Aircraft Products Division, in one of its products. Data concerning that antennae appear below:  The Aircraft Products Division is currently purchasing 5,000 of these antennaes per year from an overseas supplier at a cost of $57 per antennae.What is the maximum price that the Aircraft Products Division should be willing to pay for antennaes transferred from the Antennae Division?

The Aircraft Products Division is currently purchasing 5,000 of these antennaes per year from an overseas supplier at a cost of $57 per antennae.What is the maximum price that the Aircraft Products Division should be willing to pay for antennaes transferred from the Antennae Division?

A) $22 per unit

B) $57 per unit

C) $18 per unit

D) $40 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q99: Chiodini Incorporated has a $900,000 investment opportunity

Q100: Brull Products, Incorporated, has a Sensor Division

Q101: Division R of Harris Corporation has the

Q102: The following data are for the Akron

Q103: Youns Incorporated reported the following results from

Q105: Which of the following will not result

Q106: Fregozo Products, Incorporated, has a Connector Division

Q107: Division C makes a part that it

Q108: Division A makes a part with the

Q109: For performance evaluation purposes, any variance over