Multiple Choice

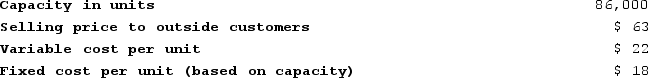

Stokan Products, Incorporated, has a Antennae Division that manufactures and sells a number of products, including a standard antennae that could be used by another division in the company, the Aircraft Products Division, in one of its products. Data concerning that antennae appear below:  The Aircraft Products Division is currently purchasing 5,000 of these antennaes per year from an overseas supplier at a cost of $57 per antennae.Assume that the Antennae Division is selling all of the antennaes it can produce to outside customers. What should be the minimum acceptable transfer price for the antennaes from the standpoint of the Antennae Division?

The Aircraft Products Division is currently purchasing 5,000 of these antennaes per year from an overseas supplier at a cost of $57 per antennae.Assume that the Antennae Division is selling all of the antennaes it can produce to outside customers. What should be the minimum acceptable transfer price for the antennaes from the standpoint of the Antennae Division?

A) $40 per unit

B) $63 per unit

C) $57 per unit

D) $22 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q325: Tommasino Products, Incorporated, has a Motor Division

Q326: Last year a company had sales of

Q327: All other things equal, which of the

Q328: Cabell Products is a division of a

Q329: The following data has been provided for

Q331: Babak Industries is a division of a

Q332: The Millard Division's operating data for the

Q333: Liapis Products, Incorporated, has a Valve Division

Q334: Schabel Corporation has two operating divisions-a Consumer

Q335: Azotea Corporation has two operating divisions-a Consumer