Multiple Choice

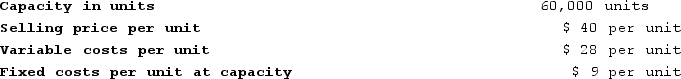

Division A of Tripper Company produces a part that it sells to other companies. Sales and cost data for the part follow:  Division B, another division of Tripper Company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $38 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.Assume that Division A is presently operating at capacity. According to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

Division B, another division of Tripper Company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $38 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.Assume that Division A is presently operating at capacity. According to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

A) $37 per unit

B) $39 per unit

C) $36 per unit

D) $38 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q285: Weafer Incorporated reported the following results from

Q286: Nasser Incorporated reported the following results from

Q287: Robichau Incorporated reported the following results from

Q288: Chavin Company had the following results during

Q289: Wiswell Incorporated reported the following results from

Q291: If net operating income is $70,000, average

Q292: The Tipton Division of Dudley Company reported

Q293: Tallon Incorporated has a $1,200,000 investment opportunity

Q294: Germano Products, Incorporated, has a Pump Division

Q295: The Millard Division's operating data for the