Multiple Choice

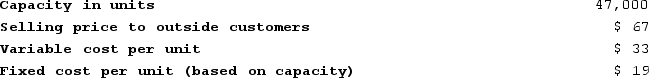

Oberley Products, Incorporated, has a Receiver Division that manufactures and sells a number of products, including a standard receiver that could be used by another division in the company, the Industrial Products Division, in one of its products. Data concerning that receiver appear below:  The Industrial Products Division is currently purchasing 5,000 of these receivers per year from an overseas supplier at a cost of $58 per receiver.What is the maximum price that the Industrial Products Division should be willing to pay for receivers transferred from the Receiver Division?

The Industrial Products Division is currently purchasing 5,000 of these receivers per year from an overseas supplier at a cost of $58 per receiver.What is the maximum price that the Industrial Products Division should be willing to pay for receivers transferred from the Receiver Division?

A) $52 per unit

B) $19 per unit

C) $58 per unit

D) $33 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q169: Ahart Products, Incorporated, has a Transmitter Division

Q170: Using the formula in the text, if

Q171: Zeilinger Products, Incorporated, has a Screen Division

Q172: Nafth Company has an Equipment Services Department

Q173: Cirone Incorporated reported the following results from

Q175: Net operating income is income before interest

Q176: Godina Products, Incorporated, has a Receiver Division

Q177: The basic objective of responsibility accounting is

Q178: Mannerman Products, Incorporated, operates an electric power

Q179: Schabel Corporation has two operating divisions-a Consumer